Swaps and Liquidity Pools in Cauldron

Cauldron is a UTXO decentralized exchange based on BCH smart contracts. In contrast to EVM DEXes like Uniswap, liquidity doesn’t reside in one single pool — in this UTXO model, capital is split across many small pools that everyone can interact with to trade.

Each Cauldron pool holds BCH and a CashToken and follows the same CPMM model used by most DEXes: after a trade, one asset goes in, the other comes out, and the asset amounts change.

Cauldron routes swaps through the existing micro‑pools like an aggregator, the user receives the desired asset instantly (without waiting for confirmations) and the pool contracts recreate themselves.

When you provide liquidity, you lock BCH and a Cashtoken in a smart contract and you earn a share of the token’s trading activity.

Cauldron itself charges no fees, swaps pay 0.3% fee to liquidity providers, and gas costs (BCH network fee) are typically <$0.01.

Nothing can block anyone from interacting with the DEX contracts — no intermediaries, no permission needed, no censorship possible.

How to Use Cauldron

Cauldron includes a built‑in, non‑custodial browser wallet you can create to interact with the DEX conveniently in a browser. However, the main way is to WalletConnect your main BCH DeFi wallet, like Cashonize or Paytaca, and interact from it.

Swapping between BCH and Cashtokens

Swapping on Cauldron is extremely simple: pick the pair, enter an amount, review the output, and press "Swap".

Currently, the most popular tokens are the MUSD decentralized stablecoin→ and FURU, the upcoming BCH prediction market’s token.

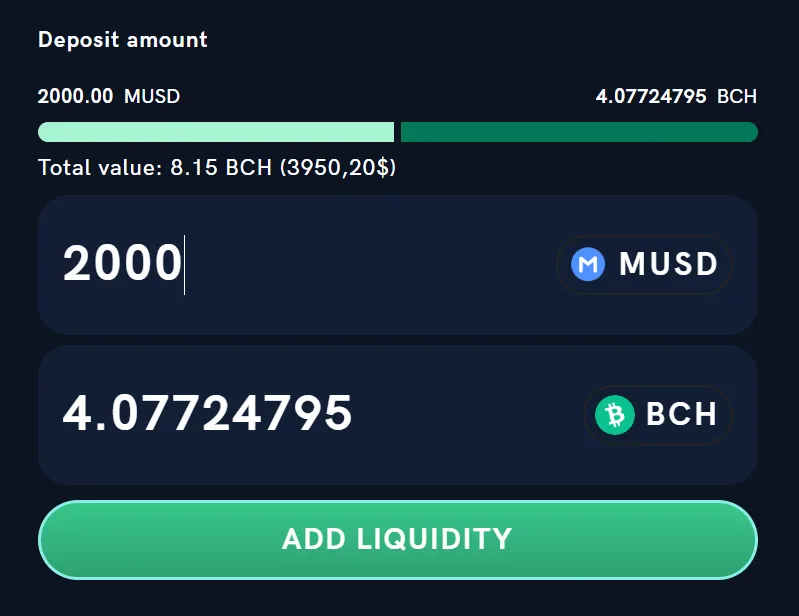

Providing liquidity to earn yield

Providing liquidity on Cauldron means creating a micro‑pool smart contract that others trade against. Anyone can open one for any BCH/CashToken pair, and liquidity can be withdrawn at any time.

What providing liquidity in Cauldron DEX looks like

Providing liquidity is market making: every time a trade passes through your pool, you earn fees and your BCH/token reserves rebalance just like in any DEX, so be mindful of impermanent loss (we’ll cover it in another article soon).

Currently, yield for providing BCH/MUSD (stablecoin) liquidity is ~12% APY.

Try Cauldron with our step by step process:

What happens if Cauldron’s website goes down?

Cauldron’s website is just an interface, a convenience layer to interact with the smart contracts. If it ever goes offline, your funds remain exactly where they always were: in the smart contract that only your keys can access.

bchcockpit→ is an independent, open-source tool built for that scenario. It scans the blockchain for your Cauldron micro‑pools and lets you interact directly with the smart contracts — allowing you to withdraw your liquidity back to your wallet even if Cauldron’s website is down.

No platform can trap your money, because no platform ever held it in the first place.

Conclusion

No accounts, no custody, no waiting for someone else’s service to stay online. Just decentralized financial tools anyone can use from a non-custodial wallet.

Try Cauldron with our step by step process: