BCH is just the settlement layer and collateral; you don't need to invest in BCH to use this DeFi trading tool.

Here's how it works and a step-by-step guide of the app (BCH Bull).

At a glance

What it looks like in practice

In short: fixed‑term, trading‑style contracts — you take the Hedge vs the asset (BCH is the collateral), while a liquidity provider acts as the counterparty (long BCH vs that asset). The app simply connects both sides and creates the contract on‑chain.

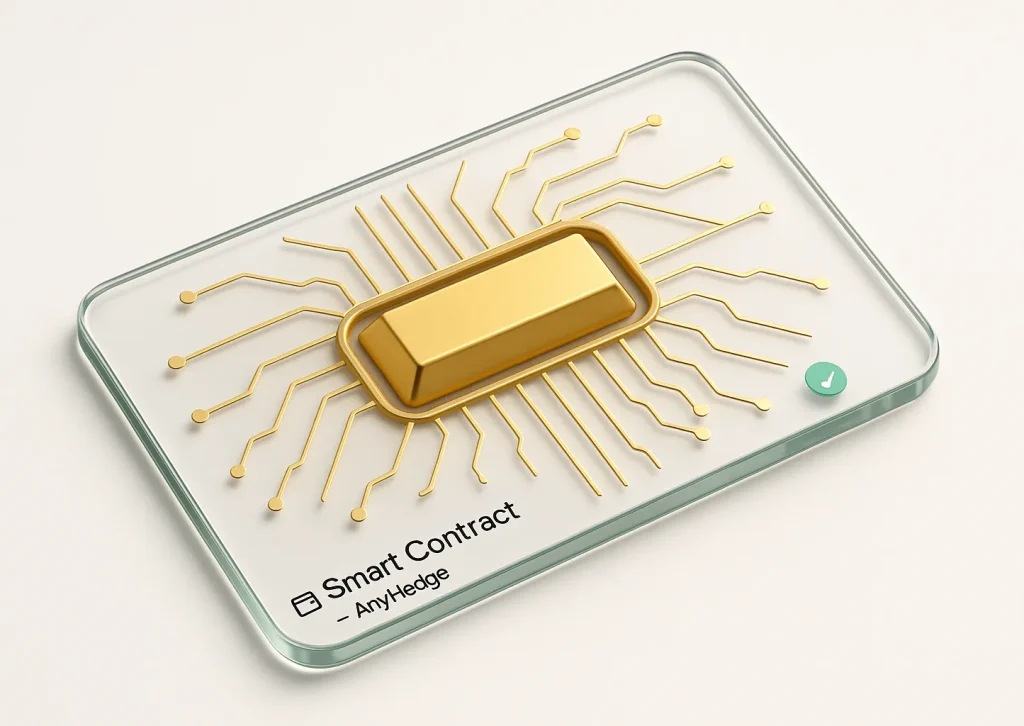

Both you and the LP lock BCH into the smart contract, a "programmed vault" in the blockchain. 100% Defi, real-world asset trading.

Express example: Gold, 3 oz for 60 days

At entry, say gold = $4,000/oz. In the smart contract you lock BCH worth 3 oz of gold ($12,000).

At maturity gold = $4,200 (+5%), your contract’s USD value moved with gold and your payout reflects that gain: BCH worth ~$12,600 (+5% USD value).

Illustrative; premiums and thresholds depend on live parameters shown in‑app.

Common questions, answered

No — funds only move from your wallet to the smart contract "vault" and back. Oracles are cryptographically signed and have a public on-chain 3+ year track record.

The liquidity Provider merely acts as the counterparty (quoting a premium based on market conditions) so that users can always enter their desired position/contract.

Settlement is enforced on-chain as per the Anyhedge protocol's smart contract rules — hard-coded behaviour. The Real-World Asset platform is a simple interface that guarantees liquidity.

No — you don’t buy or hold the asset; you get synthetic price exposure.

You don’t hold BCH nor are exposed to its price during the term either; your BCH collateral is locked in a smart-contract “vault”. At maturity, the contract releases BCH equal to the tracked asset's value to your payout address.

These contracts are decentralized, mathemathical price exposure; not ownership.

The BCH network fees to enter a contract are typically < $0.01.

The app's LP premium depends on market conditions and is shown before you fund the contract. It can even be negative (you get paid).

More information in our in-depth BCH Bull article.

Available contract durations are 2 hours to 6 months (not perpetual), and position size from $1 to 1259 BCH (~ $660k as of this writing).

No. You can swap from your current crypto into BCH and fund the contract in <3 minutes; at settlement you receive BCH and can swap back the BCH to your preferred asset. You are not exposed to BCH price until the contract is settled.

BCH is just the network that facilitates decentralized investing in RWA, not the investment itself.

The oracle can’t move funds, but if a wrong‑yet‑signed price were ever published, a contract would act on that level. The oracles in use have a 3+ year public track record and clear policies (see Oracles.Cash), and the app shows the source and last update. More details in our complete guide.

Practical use-cases

Ready to try?

Start with a $20 first experience to get comfortable first. Check out the technical details and step by step process in our walkthrough of BCH Bull — the real world assets platform.